August 2025

Technical and Client Update

In this issue

Proposed changes to inheritance tax

Class 2 National Insurance - 2024/25 HMRC system errors

Minimum wage hourly rates: potential increases in 2026

Xero price update

Exam success

Proposed changes to inheritance tax

As announced at the Autumn Budget 2024, the government has published draft legislation to reform Agricultural Property Relief (APR) and Business Property Relief (BPR) from 6 April 2026 to make them “fairer and more sustainable”.

In addition to existing nil-rate bands and exemptions, APR and BPR will continue, but a cap will be introduced that will restrict the 100% relief to the first £1 million of combined agricultural and business property. The rate of relief will be 50% thereafter.

Relief will also be reduced to 50% (with no £1m allowance) for quoted shares designated as “not listed” on the markets of recognised stock exchanges, such as AIM. The changes will take effect from April 2026.

In inevitable disappointment to business owners and farming communities, no significant changes have been made to these plans since the Autumn Budget 2024 announcement.

It has also been announced that:

- the option to pay IHT by equal annual instalments over 10 years interest-free will be extended to all property which is eligible for agricultural property relief or business property relief.

- the £1 million allowance for agricultural property relief and business property relief will be indexed in line with CPI, but will remain fixed up to and including tax year 2029/30 in line with maintaining the IHT nil rate bands at current thresholds.

Class 2 National Insurance - 2024/25 HMRC system errors

HMRC have identified an issue affecting some Self Assessment taxpayers in relation to Class 2 National Insurance contributions (NICs) for 2024/25. Some self-employed taxpayers with profits above £12,570 have seen a Class 2 NICs charge of £358.80 added to their accounts when they shouldn’t have been. In some circumstances it will be less.

HMRC say that they have taken action to correct the Class 2 NICs figure where the information they hold has allowed. If this applies to you, you will have received a message to let you know.

HMRC will correct the records of other taxpayers after the issue has been resolved and will notify them once this has been done. Taxpayers will be issued with a new SA302 tax calculation after their record has been corrected.

The issue seems to have been caused by reforms to NICs that took effect from 2024/25. Self-employed taxpayers and partnership members no longer have to pay Class 2 NICs - if their profits are over the small profits threshold (£6,725 for 2024/25), Class 2 NIC is treated as having being paid.

Minimum wage hourly rates: potential increases in 2026

The Government has published the official remit for the Low Pay Commission (LPC) to begin its work on setting the National Minimum Wage (NMW) and National Living Wage (NLW) rates that will apply from April 2026.

While the final figures won’t be confirmed until later in 2025, the direction of travel is already clear. Employers should be prepared for further increases in wage costs in April 2026.

National Living Wage likely to rise again

The Government has reiterated its commitment to ensuring the National Living Wage doesn’t fall below two-thirds of UK median earnings - a benchmark that defines the level of low hourly pay. Based on current forecasts, that means we could be looking at a NLW rate of £12.71 from April 2026, a 4.1% increase.

To put that into context, the current NLW rate for workers aged 21 and over is £12.21, up 6.7% from the previous year.

Narrowing the gap for younger workers

As part of its remit this year, the LPC will be consulting on narrowing the gap between the full NLW rate and the rate that applies to workers aged between 18 and 20 years old. The LPC will be putting forward recommendations on how to achieve a single adult rate in the years ahead.

What should employers do now?

Although the final rates won’t be known until later this year, these latest estimates are a strong indication of where things are headed. Here are a few things to consider:

- Factor these increases in when reviewing your payroll budgets for 2026.

- Consider the knock-on effect. If the NLW rises, pay for other roles may need to be adjusted to maintain structure and morale.

- Remember employer NICs and pensions. Increases in wages can also affect National Insurance contributions and pension auto-enrolment costs.

Final thoughts

The Government is clear in its aim to raise living standards through wage growth - and the LPC’s remit is designed to support that. For employers, this means keeping a close eye on wage forecasts and planning ahead for higher employment costs.

See: https://www.gov.uk/government/news/national-living-wage-estimate-update

Xero price update

We want to inform you that the price of some Xero business plans are increasing on 1 September 2025.

As a cloud company, Xero continually invests in product development, regularly releasing updates and improvements for its customers. Like many businesses, they periodically review their pricing to ensure it reflects the value of the product as it evolves, while allowing them to invest in what’s next.

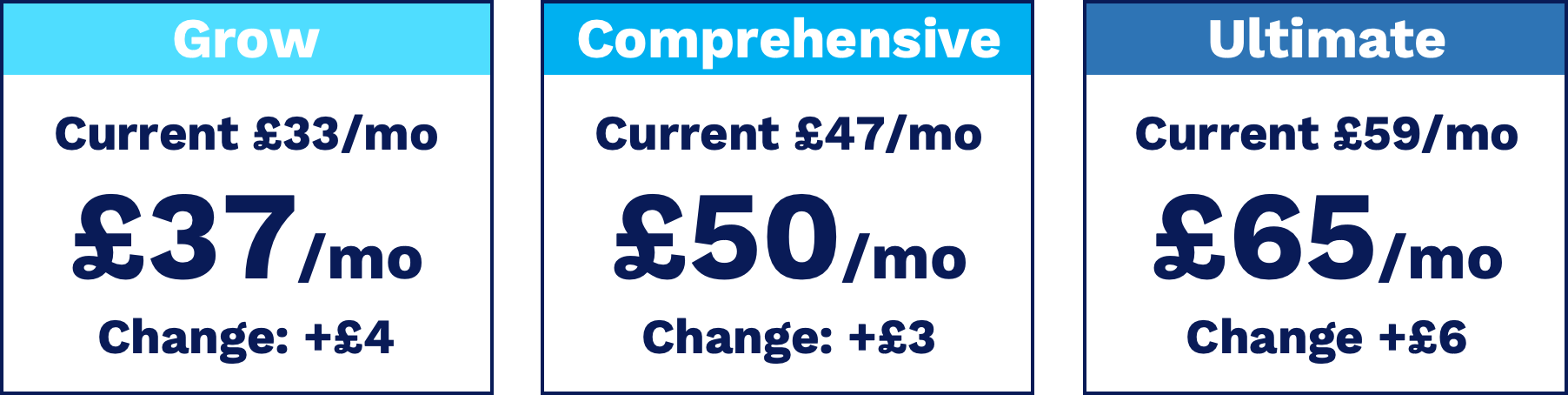

From 1 September 2025, the monthly prices of the Grow, Comprehensive and Ultimate plans will change to:

All pricing is in GBP and excludes VAT and any add-ons.

You can learn more on Xero’s website. If you have any further questions, please let us know.

Exam success

We’re pleased to announce that Maisie Tucker has passed her final exams to become a fully qualified Accounting Technician (AAT).

Maisie, who works with Partner Ian Simpson in our Hove office, will now begin her ACA training to become a Chartered Accountant.

Well done, Maisie – and best of luck with the next stage of your journey!