February 2023

Technical and Client Update

In this issue

Making Tax Digital for income tax delayed again

But new tax year basis goes ahead

New VAT penalty regime

Check your National Insurance record before 5 April 2023

130% super deduction ends soon

Important R&D changes from April 2023

Want to reduce your 2021/22 tax bill?

Pre-April tax planning reminder

Strategic planning for an uncertain year ahead

Xero price update

Exam success

Making Tax Digital for income tax delayed again

Making tax digital (MTD) for income tax self-assessment (ITSA) was originally scheduled to start in 2018 and was then put back to 2023 and then 2024. It was announced just before Christmas that the new system of submitting digital information quarterly to HMRC has been delayed yet again! The start date will now depend upon the gross business receipts of the individual.

Self-employed individuals and landlords with annual gross receipts above £50,000 will need to follow the rules for MTD for ITSA from 6 April 2026. Those with annual gross receipts between £30,000 and £50,000 will be mandated into the regime from 6 April 2027.

Whether MTD for ITSA will apply to those with gross receipts under £30,000 is under review but it would appear that the government have finally increased the starting threshold from £10,000, which they have resisted up until now.

Despite the delay in the mandatory start date for MTD for ITSA, businesses should nevertheless consider whether or not it would be beneficial to keep their business records digitally anyway.

The date when partnerships will be required to join MTD for ITSA has not been set and may be clarified in the March 2023 Budget.

But new tax year basis goes ahead

Although the start of MTD for ITSA has been delayed to 2026 at the earliest, the start date of the new regime for taxing the profits of unincorporated businesses on a tax year basis has not been delayed and the transition will still take effect in the tax year to 5 April 2024.

This will be a major change for those unincorporated businesses that prepare their accounts to a date other than 5 April or 31 March. From 6 April 2024 such businesses will need to compute their taxable profits from 6 April to 5 April each year, regardless of their accounting end date.

So, for a sole trader or partnership making up accounts to 31 December each year, their 2024/25 profits would be calculated as 9/12ths of their profits for the year ended 31 December 2024 plus 3/12ths of their profits for the year ended 31 December 2025.

This will invariably require the inclusion of an estimate of the profits of the later period with subsequent amendment once the final figures are known. For this reason many businesses may wish to consider changing their accounting date and we can of course advise you of the tax consequences.

More imminent is the change in the way that profits are to be taxed for the 2023/24 tax year. The upcoming tax year is scheduled to be a “transitional year” with complicated rules for calculating business profits. For many businesses the change will result in a higher tax bill and, if you can supply us with estimated figures, we can work with you to calculate the impact on your cash flow.

Please note that although MTD for ITSA will only apply to the self-employed and landlords initially, these tax year basis changes apply to all unincorporated businesses, including partnerships and LLPs, and those with profits of less than £50,000.

As mentioned before, those already preparing accounts to 31 March or 5 April are not affected.

New VAT penalty regime

A new, and arguably fairer, system for determining penalties for late returns and late payment of VAT applies to return periods commencing on or after 1 January 2023. The same system will also apply to the returns to be submitted under MTD for income tax, when it eventually starts!

Under the new regime, taxpayers will accumulate points for late submissions, and only after reaching a certain threshold will an automatic penalty be imposed. The threshold will depend on how regularly the taxpayer is required to submit a return. For a typical business submitting VAT returns quarterly an automatic £200 penalty will apply when 4 penalty points are accumulated. The system is designed to penalise persistent defaulters rather than those businesses that have an occasional lapse.

Check your National Insurance record before 5 April 2023

To qualify for the maximum state pension at retirement a person must have 35 qualifying years of NI contributions.

There is currently an extension in place to make voluntary contributions to plug any gaps in NI dating back to April 2006. After 5 April 2023 this will end and will revert to the normal 6 year timeframe meaning that in the 2023/24 tax year, it will only be possible to make contributions going back to the 2017/18 tax year.

You can check your National Insurance (NI) record online here to see:

- what you’ve paid, up to the start of the current tax year (6 April 2022)

- any National Insurance credits you’ve received

- if gaps in contributions or credits mean some years do not count towards your State Pension (they are not ‘qualifying years’)

- if you can pay voluntary contributions to fill any gaps and how much this will cost

If you identify any errors contact HMRC directly.

130% super deduction ends soon

Companies considering the acquisition of new plant and machinery need to be aware that the temporary ‘super-deduction’ of up to 130% for the cost of acquiring new plant ends on 31 March 2023.

Consequently, corporate businesses may wish to bring forward planned expenditure to take advantage of this enhanced tax deduction, utilising hire purchase agreements if funds are otherwise unavailable.

Depending on your business profits it may be beneficial to delay any planned capital expenditure until after 31 March 2023 due to the increase in corporation tax rates. If you are planning on acquiring new plant please contact us to discuss it further to ensure you achieve the highest level of tax relief.

Important R&D changes from April 2023

The government are committed to a number of important changes to Research & Development (R&D) tax relief from 1 April 2023. It also looks increasingly likely that the two existing systems will be merged into a single system in future years and we hope to hear more in the March 2023 Budget.

We already know that there will be a significant reduction in the tax relief available to qualifying SME companies from 1 April 2023, with the current 230% tax relief reducing to just 186%. The effect of this change combined with the reduction in the credit rate will reduce the repayable credit for loss making SMEs from £33.35 per £100 spend to just £18.60. Companies affected should consider the timing of their R&D expenditure.

For non-SME companies the R&D Expenditure Credit (RDEC) is being increased from 13% to 20% as part of the gradual alignment.

There are also important changes to the claims notification procedure from April 2023.

Want to reduce your 2021/22 tax bill?

If you would like to legitimately reduce your 2021/22 tax bill that you have just paid, or your bill for 2022/23, you might want to consider investing in shares in qualifying Enterprise Investment Scheme (EIS) companies.

Under this HMRC approved scheme every £1,000 you invest reduces your tax bill by £300 (30%), provided you are not connected with the company. Broadly you are not allowed to be an employee or control more than 30% of the company.

The reduction in your tax bill is available in the tax year in which the shares are issued, however you may elect to treat some or all of the shares as issued in the previous year and claim tax relief in that previous year.

If you are prepared to take more of a risk by investing in small start-up companies, the Seed EIS scheme provides a 50% tax deduction on up to £100,000 of investments.

Although we can advise you on the tax advantages of investing in EIS and Seed EIS companies you will need to consult with a suitably qualified Independent Financial Adviser who will help you find investments appropriate to your needs.

Pre-April tax planning reminder

The new tax year starts 6 April 2023, so you only have a few weeks to consider your options. Once we pass this date the majority of the tax planning options for Income Tax and Capital Gains Tax purposes will cease unless actioned before the 6 April.

Do you fall into any of these categories?

- You have or are thinking about a change in your personal status (single, married, separating, joining or dissolving a civil partnership);

- You are thinking about selling a capital asset, such as shares or a property. From 6 April 2023 the Capital Gains Tax annual exempt amount reduces from £12,300 to £6,000. The reduction also applies to trusts. The standard trust annual exemption is reducing from £6,150 to £3,000;

- You or your child’s other parent claims Child Benefit and the income of either parent is likely to exceed £50,000 for the first time during tax year 2022-23;

- Your annual income is approaching or above £100,000;

- You have not yet topped up your pension contributions for tax year 2022-23 or are considering utilising unused annual allowances from prior years;

- You are self-employed with a 31 March 2023 year-end;

- You are self-employed and are thinking about the purchase of equipment or vehicles; or

- You are the director and/or shareholder of a limited company and have not yet considered voting final dividends or bonuses for 2022-23;

- You are considering making gifts to family or friends.

If you do, and you would like to discuss ways to mitigate the tax implications, please get in contact in advance of the 6 April deadline.

The above list is not comprehensive. We specialise in helping clients with all taxes including PAYE, NIC, VAT, Corporation, Capital Gains, Income and Inheritance tax.

Strategic planning for an uncertain year ahead

Businesses are going to have to navigate through an uncertain year in 2023.

One thing is certain this year, and that’s uncertainty. Inflation is driving costs higher; interest rates are at their highest level in years and the outlook for the economy is gloomy.

To navigate through all of this uncertainty, businesses need to focus on developing effective plans which can be adapted if market circumstances change quickly. The best businesses have three types of plans:

- Strategic plans – these are the overarching objectives for the business and look ahead to where you want to be in 3-5 years.

- Tactical plans – these support strategic plans and are the roadmap for achieving each of the strategic objectives. They outline the specific responsibilities and deliverables of each team across the business in order to make the strategic plan successful.

- Operational plans – these focus on the processes, procedures and tasks that must be accomplished in order to achieve the firm’s objectives. Operational plans include finance, procurement, production, logistics, human resources, premises, communication and sales.

Given the uncertainty that all businesses are facing, it’s important to plan for unforeseen circumstances. As such, you must train your team members to embrace change and be ready to adapt.

So why plan at all if everything is subject to change? Putting strategic, tactical and operational plans in place and communicating the objectives of these plans across your entire business gives everyone something to aim for. If everyone in your business has clear objectives and understands them, they will, at the very least, keep moving in the right direction. Then it’s up to the management team to implement changes of direction if things change and the firm needs to adapt.

A good management team needs to embrace uncertainty. The key is to avoid developing a strategy as though we know the future. Instead, the management team needs to try to calculate the chances of success for each strategic move and then plan to move forward with the strategies and tactics that have the best chance of success. This ensures that the firm’s resources are always focused on the things that are most important in ensuring overall success.

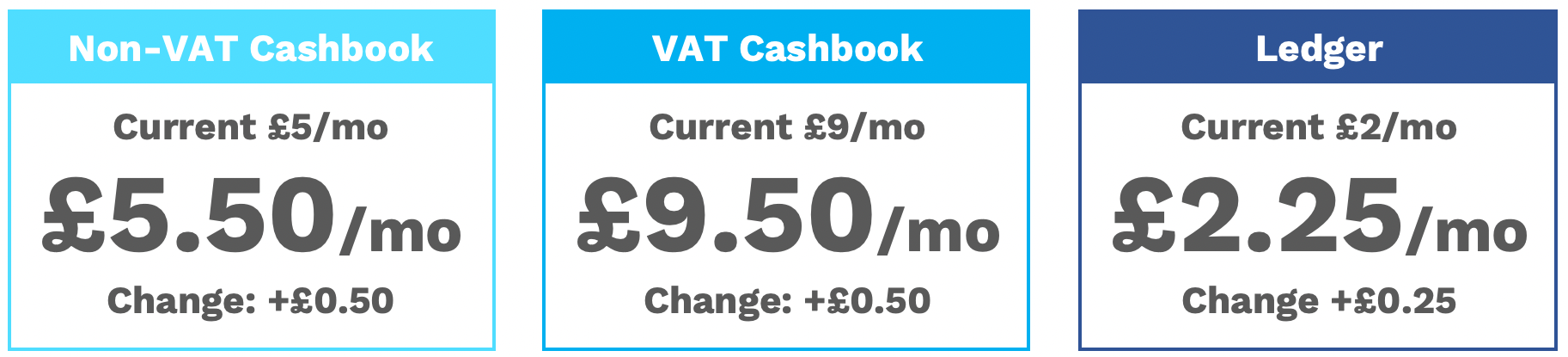

Xero price update

As a cloud company, Xero continually invests in product development, regularly releasing updates and improvements for its customers. Like many businesses, they periodically review their pricing to ensure it reflects the value of the product as it evolves, while allowing them to invest in what’s next.

From 15 March 2023, the monthly price of Cashbook and Xero Ledger plans is changing as follows:

All pricing is in GBP and excludes VAT and any add-ons.

You can learn more on Xero’s website. If you have any further questions, please contact Xero Support.

Exam success

We are pleased to announce that Harry Woodrow has passed his final exam to become a fully qualified Accounting Technician (AAT). Harry works for Partner Craig Manser and looks forward to using his knowledge to assist clients with their accounting and tax needs.

We are delighted to have yet more exam success within the firm and congratulate Harry on all his hard work in achieving this qualification.