February 2024

Technical and Client Update

In this issue

Year end tax planning

Self-Assessment payments via the HMRC app treble to £121 million

Going paperless!

Xero price update

Exam success

Local charity support

Year end tax planning

It’s not too late to undertake some end of year tax planning. If you have some spare cash, an obvious tax planning point would be to maximise your ISA allowances for the 2023/24 tax year (currently £20,000 each). You might also want to consider increasing your pension savings before 5 April 2024.

USE A LIFETIME ISA (LISA) TO SAVE FOR YOUR FIRST HOME

Those aged between 18 and 40 can set up a Lifetime ISA (Individual Savings Account) to buy their first home or save for later life. You can put in up to £4,000 each year until you’re 50. The government will add a 25% bonus to your savings, up to a maximum of £1,000 per year. Note that the Lifetime ISA limit of £4,000 counts towards your £20,000 annual ISA limit.

You can withdraw money from your ISA if you’re:

- buying your first home,

- aged 60 or over, or

- terminally ill, with less than 12 months to live.

However, you’ll pay a withdrawal charge of 25% if you withdraw cash or assets for any other reason (an unauthorised withdrawal). This recovers the government bonus you received on your original savings.

PENSION PLANNING

Under the current rules, the government adds to your pension contributions at the basic rate of tax of 20%. For instance, if you save £4,000 in a personal pension, the government tops this up to £5,000. If you are a higher rate taxpayer there is a further £1,000 tax relief when your tax liability is calculated, reducing the net cost to £3,000.

Additional pension contributions can be even more effective if your income is between £100,000 and £125,140 as the gross pension contribution reduces net income for the purposes of the reduction in the personal allowance. Note that for every £2 of income in excess of £100,000, the £12,570 personal allowance is reduced by £1, with reduction to nil where net income is £125,140 or more. This is effectively a 60% tax saving.

CAPITAL GAINS TAX PLANNING

You might wish to consider bringing forward capital gains to before 6 April 2024 where you haven’t used your £6,000 CGT annual exemption. This exempt amount reduces to just £3,000 for gains made in 2024/25.

CAPITAL EXPENDITURE PLANNING

Unless the business year end is 31 March or 5 April, the end of the tax year is not a significant date as far as capital allowances are concerned. In order for new equipment to attract capital allowances, the expenditure must be incurred on or before the end of the accounting period. Limited companies buying new (not second hand) equipment are entitled to fully expense the cost of most acquisitions against business profits. There is no financial limit on expenditure qualifying for this “full expensing” relief.

Unincorporated businesses are entitled to 100% write off for the first £1 million spent on new and used equipment in a 12 month period. This “annual investment allowance” (AIA) is also available to limited companies buying second hand equipment. The AIA does not apply to motor cars but there is a special 100% tax relief if you buy a new zero-emissions motor car.

Where equipment is bought under a hire purchase contract, the capital allowances outlined above are available on the full cost of the asset provided it has been brought into use by the end of the accounting period. This is despite the fact that the payments may be spread over a number of months.

Self-Assessment payments via the HMRC app treble to £121 million

Almost 100,000 tax-payers have paid £121 million using the HM Revenue and Customs’ (HMRC) app since April 2023, taking advantage of the new way to pay their Self-Assessment tax bill.

Latest figures from HMRC reveal that between April and September 2023, 97,365 taxpayers used the app to settle their tax bill for the 2022 to 2023 tax year – more than 3 times the £34.6 million paid by 36,467 taxpayers during the same period last year.

Tax-payers have been able to pay their Self-Assessment tax bill via the free and secure HMRC app since February 2022 and there is a YouTube video demonstrating how to make a payment.

See: Self Assessment payments via the HMRC app treble to £121 million - GOV.UK (www.gov.uk)

Going paperless!

We are trying to go as paperless as possible. In early 2024 all statements and receipts will start to be sent electronically.

Receipts will be sent via our online portal Virtual Cabinet. If you have not used the Portal before, when a receipt is issued, you will receive an email from Virtual Cabinet asking you to create an account in order to access these documents.

If you would prefer to receive these documents in the post please let us know by emailing info@humph.co.uk.

Xero price update

As a cloud company, Xero continually invests in product development, regularly releasing updates and improvements for its customers. Like many businesses, they periodically review their pricing to ensure it reflects the value of the product as it evolves, while allowing them to invest in what’s next.

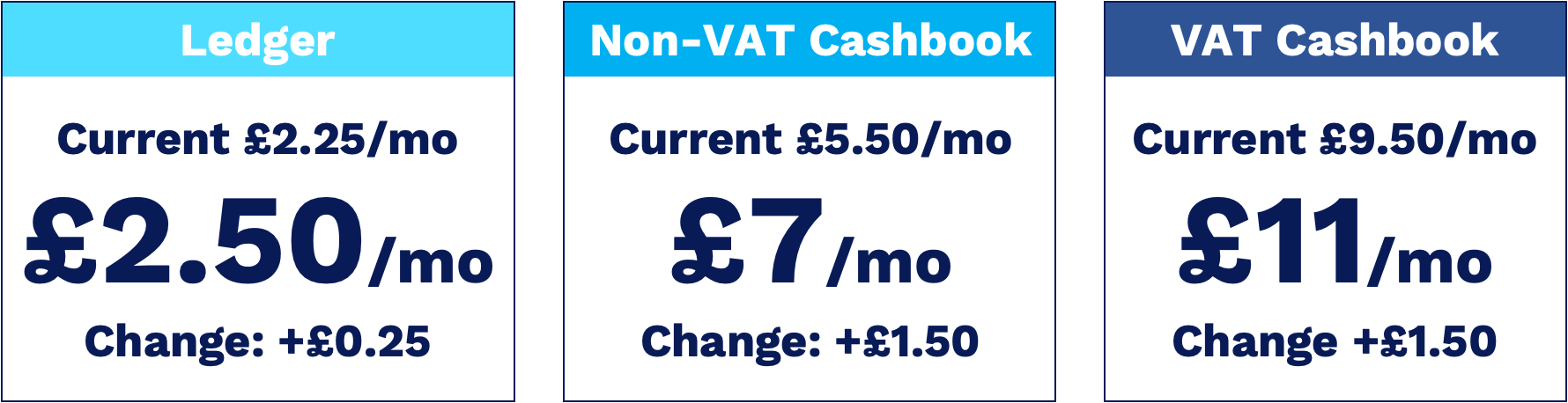

From 5 March 2024, the monthly prices of the Ledger, Non-VAT Cashbook and VAT Cashbook plans will change to:

All pricing is in GBP and excludes VAT and any add-ons.

You can learn more on Xero’s website. If you have any further questions, please let us know.

Exam success

We are pleased to announce that Lucas Belim has passed his exams to qualify as a Chartered Accountant (ACA).

Lucas joined the firm in 2015 as an Apprentice Accounting Technician (AAT) qualifying in 2017, he then went on to qualify as a Taxation Technician (ATT) in January 2019. Lucas achieved his Chartered Accountancy qualification (ACA) in January of this year. Working for Partner Craig Manser Lucas assists with a wide portfolio of business clients, particularly the tax affairs of Barristers.

“I am delighted to qualify as a Chartered Accountant and I am grateful for the support offered by Humphrey & Co, and family and friends, along the way. I am incredibly proud of the determination, resilience, and perseverance I have shown over the years; despite several challenges and setbacks I never gave up. I look forward to using the ACA qualification to provide the best possible service in assisting our clients with their accounting and tax needs” said Lucas.

Senior Partner Anthony Smith comments “The partners are delighted that Lucas has secured his ACA qualification; it’s been quite a journey for him but he has shown a gritty resolve to reach his goals – a characteristic that is almost as important as the qualification itself! Lucas is a real asset to the firm and we are confident he will use his new skills to help our clients both with compliance work and planning opportunities, in a fast changing environment.”

Local charity support

The firm is pleased to announce that our Charity of the Year for 2024 is the St Wilfrid’s Hospice.

St Wilfrid’s Hospice provides high-quality care and support for people across Eastbourne, Seaford, Hailsham, Uckfield, Heathfield (and all points between) with life-limiting illnesses. Support is offered at the hospice, in patients’ own home and in care homes. Over 70% of the funds to provide these services comes from voluntary donations.

For more information visit: https://www.stwhospice.org/

We will update you on the funds raised during 2024 in future newsletters.