October 2023

Technical and Client Update

In this issue

Increased corporation tax rates

Child benefit may create a tax charge for those with high income

Find a grant service

Government gateway and personal tax accounts – reminder

Xero price update

Exam success

Increased corporation tax rates

From 1 April 2023 the rate of corporation tax that a company pays depends on the level of the company’s profits and the number of “associated companies”. “Associated companies” are those under common control, which may include companies controlled by close relatives under certain circumstances.

Assuming a company has no “associated companies” then the 19% corporation tax rate continues to apply where profits are no more than £50,000 and the 25% corporation tax rate applies where profits exceed £250,000 a year. The £50,000 and £250,000 limits are divided by the number of “associated companies”.

In between the limits there is marginal relief to achieve the transition between 19% and 25%. The marginal tax rate between £50,000 and £250,000 is 26.5% and thus tax planning can be particularly effective.

For example buying new equipment or paying additional pension contributions on behalf of the directors would potentially save 26.5% corporation tax. Timing of expenditure is critical here, as the expenses would need to be incurred before the year end. We would recommend a review at least 2 months before the company’s year-end, with reliable profit forecasts available to allow time for pre-year-end planning.

When are companies associated?

“Associated companies” for corporation tax purposes are those under common control. The most obvious situation is where one of the companies has control of the other, or both of the companies are under the control of the same person or persons. In determining control, the rights and powers of an individual’s associates, broadly close relatives, may be taken into consideration, but only where there is substantial commercial interdependence between the two companies. This could be financial, economic, or organisational interdependence and will depend on the facts of each case. An example would be where a brother and sister each have their own limited company and there is a large loan or significant trading between them, such that one is dependent upon the other.

This is not a straightforward area and we can, of course, assist you in identifying the number of associated companies.

Child benefit may create a tax charge for those with high income

Parents and carers need to be aware that if either of the couple have ‘adjusted net income’ in excess of £50,000 then the one with the higher income will potentially be charged to tax on some or all of the child benefit and will need to request a self-assessment tax return to report the amount of child benefit received in the tax year. The High Income Child Benefit Charge (HICBC) was introduced in 2012/13 and imposes a 1% charge on the amount of child benefit received for every £100 that the taxpayer’s adjusted net income exceeds £50,000. ‘Adjusted net income’ is an individual’s total taxable income before any allowances, but after deducting Gift Aid, pension contributions and trade union subscriptions.

Where the adjusted net income is £60,000 or more, then 100% of the child benefit is charged, effectively fully clawing back the child benefit. Note that the £50,000 threshold has not been increased since it was introduced in 2012 which means that more and more parents are being caught by the HICBC each year. It has recently been announced that in future years the government plans to deduct HICBC directly from salaries via PAYE.

It is possible to opt out of receiving Child Benefit payments where adjusted net income exceeds £60,000. Consequently, the HICBC would not apply and the child benefit would not need to be reported on the tax return. That may mean that a taxpayer who has their tax collected under PAYE would not be required to submit a self-assessment tax return. It is important to still fill in the Child Benefit claim form but state on the form that you do not want to get payments. That is important as the claimant would then receive National Insurance credits for that year, which count towards their State Pension entitlement.

One of the problems with the HICBC is that those taxpayers who pay their tax under PAYE are not normally required to file a self-assessment tax return. However, if they are parents and one of the couple is in receipt of child benefit then they are required to request a self-assessment tax return from HMRC to report the child benefit if their adjusted net income exceeds £50,000 a year. HMRC have started assessing taxpayers to HICBC where they have not reported their child benefit in earlier years. Several taxpayers have successfully challenged these assessments through the courts in a number of recent tax cases. Whether or not a successful appeal can be made will depend on the circumstances in each case.

Find a grant service

Find a grant is a UK government service that allows businesses to search all UK government-funded grants. Businesses can use the website to browse or search for available grants, check if they are eligible, and find out how to apply for each grant.

Anyone can use the UK government Find a grant service to find and apply for grant funding. Each funding opportunity has its own eligibility criteria and scope. There is no cost to use this service.

You can also sign up to get updates about new grants.

See: Home - Find a grant (find-government-grants.service.gov.uk)

Government gateway and personal tax accounts – reminder

Of course, we at Humphrey & Co are always on hand to assist you with providing and managing some of your tax information. However, we do recognise that there may be instances where you may need access to this tax information. HM Revenue & Customs provide a secure online facility to allow individuals to check, update and manage their tax details, with the aim of contacting HMRC more quickly and easily.

The service allows you to:

- Check your income Tax estimate and tax code

- Check your state pension

- Check income from employment and how much tax you have paid in the previous 5 years

- Check or update your Marriage Allowance.

- Telling HMRC about a change of address

- Check or update benefits you receive from employments such as company car and medical insurance benefits.

- Find your NI number and Unique Taxpayer Reference (UTR) (if applicable)

To sign up , please visit Personal tax account: sign in or set up - GOV.UK (www.gov.uk)

To do so, you will need to register for a Government Gateway account and provide personal data to prove your identity. When applying for a government gateway account for the first time, you will need to provide your National Insurance number or postcode plus 2 of the following:-

- A valid UK passport

- UK Photocard driving licence issued by the DVLA

- A payslip from the last 3 months or P60 from your employer

- Details from a Self-Assessment Tax Return if you have submitted one previously

- Information held on your credit record

- Details of a tax credit claim if you made one

Once you have enrolled, you will then be able to access the Personal Tax account.

HMRC also has a dedicated App, for more information and details on how to access the app please visit the HMRC website - Download the HMRC app - GOV.UK (www.gov.uk)

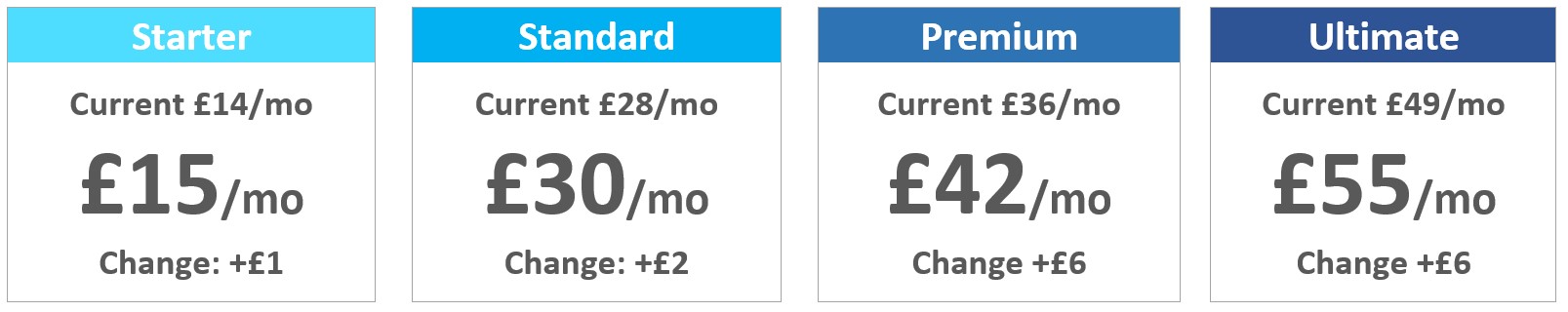

Xero price update

As a cloud company, Xero continually invests in product development, regularly releasing updates and improvements for its customers. Like many businesses, they periodically review their pricing to ensure it reflects the value of the product as it evolves, while allowing them to invest in what’s next.

From 13 September 2023, the monthly prices of the Starter, Standard, Premium and Ultimate plans have changed to:

All pricing is in GBP and excludes VAT and any add-ons.

You can learn more on Xero’s website. If you have any further questions, please let us know.

Exam success

We are pleased to announce that Aaron Capps and Chelsea Snowden have passed their final exams to become fully qualified Accounting Technicians (AAT). Aaron works for Partner Ian Simpson in our Hove office and Chelsea works for Partner Greg Penfold in our Eastbourne office.

We are delighted to have yet more exam success within the firm and congratulate Aaron and Chelsea on all their hard work in achieving this qualification.